- 20. August 2020

- Posted by: Dopplersaufer

- Category: BitCoin, Blockchain, Cryptocurrency

We still live in the wild west days of crypto currency adoption and the movements of some coins are someteims still erratic and can´t be explained by fundamental or technical analyses. The fact that even today, there are still countries trying to outright ban crypto currencies are not helping as well but it´s not only outside interference that is necessary to consider.

The recent DeFi hype showed it perfectly that a random altcoin can be pushed to the moon by a relatively small amount of users. That holds the potential of a pump and dump scheme which means the originator tries to push a worthless coin and sells it when the price has manifold, usually letting countless unknowledgable investors behind who are then destined to hold their now again worthless coins for all eternity.

Conducting your own due dilligence is crucial for long term success just as much as keeping your emoitions under controll to now jump the next hype coin bandwagon and maybe get burned in the process as a lot of people had with them YAM desaster.

That said, lets start with the first coin of our crypto forecast series that should help you make better decisions based on better information about a certain cryptocurrency asset. Let me introduce you to:

Chainlink – the „new“ player on the field

Who is behind Chainlink?

Chainlink was developed by Sergey Nazarov a son of Russian immigrants who came to America in the early 1990. He went to school in New York and eventually majored in Philosophy & Management. It was there were he meet his first future employer FirstMark Capital. To start at the Venture Capital company should have been tremendously important in the next years and even more with the funding of Chainlink. Sergey didn´t stopped there and accomplished thigns like building a prototype for SWIFT or and being named in the executive chairman of the World Economic Forum’s book on revolutionary trends.

Sergey left his employer in 2011 and decided to went all out on cryptocurrency, joining the revolution. After a short stint in Russia he returned to the states and started diving deep into blockchain technology eventually founding Chainlink in 2013 with his co-founder Steve Ellis and a HQ on the Cayman Islands.

After working on use cases, compatibility, and the underlying oracle system, they held an ICO (Initial Coin Offering) in september 2017, in the middle of the ICO bubble. The hype at this time was maybe also a reason why they relatively easy managed to raise 32M USD by selling their own native LINK token. At this stage, Nazarovs connections to the world of Venture Capital turned out to be benefitial since they managed to get e. g. A huge name like Framework Ventures on board.

In the ICO just 35% of the total supply of coins where solt to the public, while 32% were sent to node operators and 30% remained with he Chainlink core team to secure the continuously development.

Why is $LINK important?

What they saw was „data = money of the future“ and he who processes money/data can be a crucial partner for all kinds of business verticals in the future. What LINK does, is to connect real life data and puts it on a blockchain where it can be processes by smart contracts and veryfied by oracles. That guarantees a high level of safety but most importantly a prerequisite for a plethora of use cases. Read here about their collaboration with POLKADOT $DOT

Chainlinks mission with the $LINK coin

The main problem they tried to solve was to connect smart contracts in touch with external data resources. It enables developers to build better and more comprehensive applications backed by tamper-proof digital agreements.The world is already very well connected, but Chainlink connects it even more.

If you are just here for the trading, you can skip the next part.

Chainlink crypto coin – The technology behind

Basics first, what is a smart contract?

A smart contract is a piece of code at first. Think of it as a little application that serves as a

digital agreement between two parties to trigger a certain event. On the blockchain it is by definition unalterable and runs on decentralized nodes, aka the coins network.

How Chainlink crypto works

I try to reduce the complexity here and add a link to the LINK Github page on the end of this post. If you are a developer this might be more useful to get a deeper insight on Chainlinks modus operanti.

Basically, the LINK coin is the cryptocurrency native to the Chainlink blockchain. It has a decentralized oracle network in which it acts as a means of payment to the nodes operators. As an incentive to hold more Chainlink coins, someone who holds a large number of LINK can be rewarded with larger contracts. Thus earning more LINK in the process. The inherent security system also takes care that nodes that fail to deliver accurate information get deduced of tokens.

A developer described LINK as “an ERC20 token, with the additional ERC223 ‘transfer and call’ functionality of transfer (address, uint256, bytes), allowing tokens to be received and processed by contracts within a single transaction.” quote

What are those Chainlink oracles?

Oracles are the data feeders of the blockchain. Based on its nature, a blockchain can´t control nor even access data outside its own network. Oracles make exactly that possible!

Oracles import real life external data like birthdates or temperature into the blockchain which activates a smart contract to trigger a predefined task. A Chainlink client can request the implmentation of his data by simply get in touch with the Chainlink network. The smart contracts will interact with the oracles and provide the framework the data is processed. For safety reasons, the contracts include a reputation clause, an order-matching clause and an aggregating clause.

All those technical developments didn´t remain unseen by the incumbents of technolgical

so it´s no wonder that various big and not so big names approached the Chainlink team for cooperations.

Cooperations

Chainlink has been able to work with companies like Google and Oracle but with smaller and very interesting crypto projects as well.

The Google deal

We all know that Google is a huge data centric organization that collects everything that is somehow digital it can get. That´s not necessarily a bad thing becaus that data can be used by their analytics platform BigQuery. This platform allows large amounts of data from multiple blockchains to be analyzed and valued. Their problem till now, how to get those data on a blockchain….

That´s why Chainlink came in to help. It will act as the middleman between smart contracts and Google’s real-world data.Chainlink will be the bridge to Googles path towards blockchain adoption.

Here the statement from Google

The Oracle deal

Almost right after the announcement about the collaboraton with Google, the one with Oracles Startup office got published. The idea is to help startups (for free) to use Chainlink’s decentralized oracle tech to monetize APIs via smart contracts on the Oracle blockchain platform.

Quote

We are going to co-develop Chainlinks with 50 qualified startups to prepare them to sell their data to Oracle’s 430,000 customers in 175 countries on the Oracle Blockchain Platform. – Fernando Ribeiro, senior manager with Oracle for Startups.

Polkadot

The Polkadot project is lead by Ethereum Co-founder Gavin Wood and try to solve the problem of blockchain interoperability. Maybe the second most important problem to solve beside the interaction of real life data getting transported o the blockchain. Here more info

The Web3 Foundation

Speaking of Polkadot, you can´t ignore the Web3 foundation which manages interoperability blockchains. They as well have inked a connection and collaborative agreement with Chainlink. Here the details

OpenZeppelin

OZ provides tools to write, deploy and operate decentralized applications. They also perform security audits for the protection of large organizations. More info: https://blog.openzeppelin.com/chainlink-partnership/

Open Law

Open Law uses Chainlinks oracle system to determine exchange rates between Ether and US dollars.

With all those partners in the back, it´s easier to work and make progress. Now lets have a look at some of the many use cases of Chainlink.

Use Cases

Importing real life data into the Blockchain is a use case that a plethora of companies across all business verticals will soon have a need of. $LINK solves exactly that issue, and therefore it´s no miracle that it just recently became 5th place on CoinMarketCap regarding the most traded tokens. Their specific use of smart contracts could be applied to finance, supply chain, payment applications, insurance and actually every other application. In other words, whenever a smart contract requires reliable off-chain data, Chainlink is the protocol to go to. Just imagine what happens when a Hapag Lloyd or a Maersk announce the use of Chainlinks systems for their supply chain networks. It will skyrocket even more than it already did.

Use in Finance

When i comes to money and transfering it, nothing os more important then security and reliability. To take out human error of the equation is a crucial step towards more safety and establishing trust in the system.

Chainlinks smart contracts can be used e. g. to eliminate counterparty risk or automate financial products, like in trading or funds mangement. Chainlinks oracles act as the decentralized, trusted intermediaries that secure the execution of financial interactions.

Other places of Chainlink implementation could be in the field of Derivatives. LINK can enforce the automated exectution and collect prices from various sources into one single point of access.

A similar thing can be done with bonds. Chainlink contracts can be used as an automated payout fiat currency, eliminating the above mentioned counterparty risk.

Further use cases could be applied to all kids of funds, ETFs, certificates or commodities or even other crypto currencies. Think of relable data aggregation and adjustment regarding exchange rate fees triggered by smart contracts,

DeFi

Given credit to the currently over-hyped DeFi projects, there are a few that stand out that have a bright future ahead. Again the chances of survival are the highest for those with a real life use case. Chainlink crypto currently collaborates with DeFi protocols Aave and Synthetix.

Use in Supply chain

Probably the easist to imagine use case. Think of the production of a good, the transportation on various means, like truck, ship or plane and the necessary checks, like if a certain step in the production line is done or if has arrived at a certain checkpoint for further transportation.

Smart contracts can reduce the hussle and revolutionize auditing or manual sampling of inventories and delivered goods. Sensors could be connected to check the transported goods temperature, like in case of food delivery. The smart contracts could monitor the quality as well, like giving feedback at certain parts of the transportations way and inform the merchant and his storage department.

Use in Gaming

Here we start with regulated gambling which has insane potentials (for profits) when adjusting to smart contract technology. Chainlink crypto can here act as a verification devvice to deliver deterministic outcomes for betting results and true transparency. Something rare this kind of business.

Another idea are Dapps on the Chainlink blockchain which provide tamper-proof ways to connect with software that simulates pure randomness. Again, everything automated by a smart contract without the chance of human interevention pro or con a certain player or a specific playing style.

Use in Navigation

This is an example that Sergey himself came up with in a recent interview: Think about a the data of a navigation app, all the data generated. Certainly that is a huge amount of data and it can´t be stored on the blockchain for obvious reasons. However, using the BigQuery table in Google Cloud in combination of the Chainlink oracle system things start to become interesting. Chainlink oracles validate a participants data and judge if useful or not. If it is, LINK calculates an appropriate bounty and triggers a smart contract to pay transfer the coins (payment).”

There are many more and if you want to, check out the Chainlink website with a list of 44 further use cases including some from Insurance and enterprise systems.

Chainlink price prediction – Chainlink price forecast

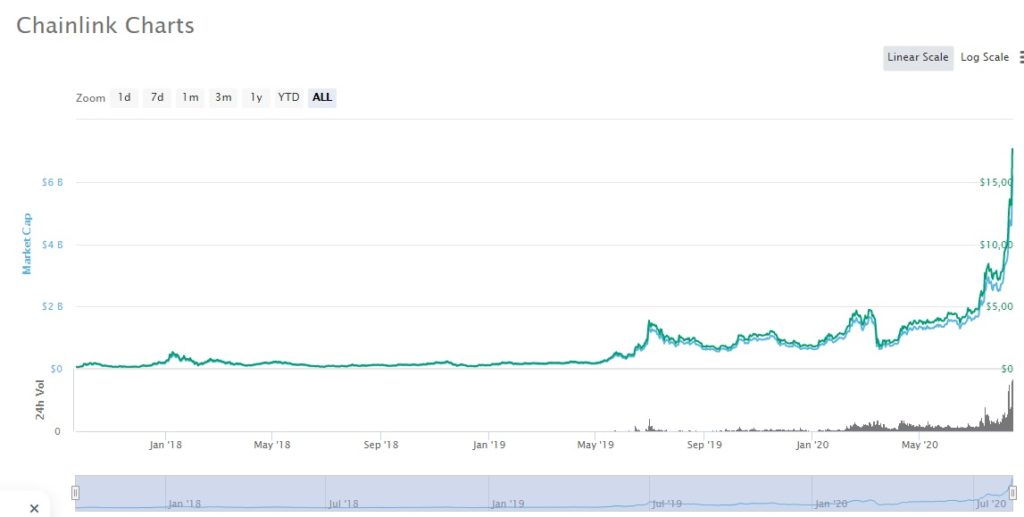

Chainlinks crypto use cases have the incredible advantage of seperating it from the actual crypto currency market. That can be seen best in its low correlating with the industry leader, Bitcoin. Beside that, LINK coin gained over 800% in 1 single year, a stunt not every crypto currency was able to pull off in a sustainable manner. That meteoric rise secured Chainlkink coin the 5th place on Coinmarketcap with a total market cap of about 6B USD.

According to crypto obserrver Trustnodes, Chainlink developers have sold about $40 million of link tokens in July. „About 500,000 of the link tokens are getting sent every week to the cryptocurrency exchange Binance and other venues“ quote . LINK gained moentum because of the recent DeFi hype and the perceivee dpotential of that busines vertical.

After a strong performance in July, during which it hit a new all-time high, technical analysts are cautiously bearish. But lets have a closer look at the charts.

Both chart pictures taken from Coinmarketcap.com

An unprecedented gain asks for an unprecedented correction. We have seen that in all kinds of markets, not limited to cryptos. Currently (middle august 2020) the Crypto Volatility Index (CVIX) shows another ATH but not one we want to see from a crypto currency. The CVIX anges from 0 to 100, where 0 is no fluctuation, and 100 high fluctuation. Chainlink shows a whopping 94 at this point which means that trader are in for a significant change of price in this direction or the other. Safety first, close stopp losses and a clear observation are key to stay profiutable in such times. The main reasons are high likely the connection of LINK to the DeFi hype, including all it´s ups and downs as with the recent burst of YAM token.

In the recent months, LINK has grown in value to hit its ATH at $20 USD. The charts show that the there is no real correction visible so its possible we will face one soon.

A support is at around 16.- and around 14.-. An increase again over the 17.- mark would be bullish again, ust as much as the reach of a new All Time High. The next evels would be 20.- and eventually 30.- as the next target ATH.

There are still doubt sin the DeFi bubble and a burst could happen with one of their coins which in return would have an impact on the Chainlink crypto price. However, the use cases are there and LINK/USD bulls are fighting hard to surpass the resistance level at $20 to start the journey to $30 while defending against going below the 14,. line.

Conclusion

Chainlinks future looks bright and minor DeFi troubles can´t stop something that has so many different use cases and obvious improvements on various business spaces.

According to Google Trends, the information demand in the USA regarding Chainlink is at a high as well and the recent endorsement from social influencer Dave Portnoy helped elevate that popularity even more.

Chainlink is here to stay and if more and more big tech companies decide to coolaborate with them ,the can easily surpass even the market cap of Bitcoin one day. The chanceas are there.

Links:

Link Whitepaper – https://link.smartcontract.com/whitepaper

Chainlink on Github https://github.com/smartcontractkit

Wanna swap Chainlink Coins? Do it here!